August 2024 Mid Atlantic Region

Power prices across the PJM grid just surged 800% year over year, and this time it’s not speculation. Goldman Sachs says the jump reflects a new reality: AI data centers are rapidly outpacing grid capacity, and supply can’t keep up.

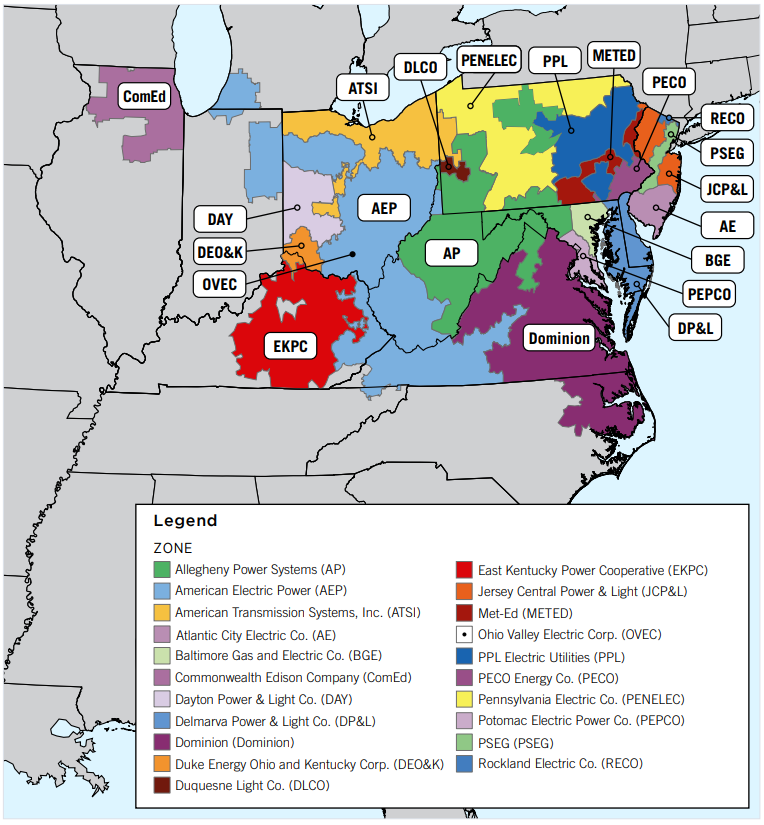

In PJM’s latest capacity auction (2025-26 planning year), prices cleared at $269.92/MW-day, the highest in history. In key zones like Dominion (VA) and Baltimore Gas & Electric (MD), prices hit maximum caps of $444.26 and $466.35, with actual capacity shortfalls still to be reported.

- Goldman’s call: “Capacity prices have finally caught up with the generative AI data center load growth story.”

This isn’t just a utilities story, it’s a signal of structural dislocation between energy demand and available infrastructure in the Mid-Atlantic, one of the most economically active regions in the U.S.

- Limited new supply: 4-5 years to bring new capacity online

- Policy friction: Maryland’s ban on new fossil fuel plants limits in-state buildout

- Grid stress: AI clusters require 24/7 stability; volatility is no longer acceptable

The result? High prices are the new baseline, and they’re spreading beyond core metro zones.

Where Smartland Energy Fits In

At Smartland Energy, we’re actively evaluating project sites in Tazewell County, Virginia, a zone adjacent to high-stress grid areas, but with greater development flexibility and local natural gas access.

This latest PJM auction reinforces why behind-the-meter generation, resilient site infrastructure, and local energy independence are no longer fringe, they’re strategic.

If you\’re watching:

- The scale-up of AI and industrial compute

- Power price volatility

- Grid reliability as a risk to growth

…this is a data point worth acting on.