America’s largest power grid is running out of room. And if you’re tracking energy infrastructure or the AI boom, that should be on your radar.

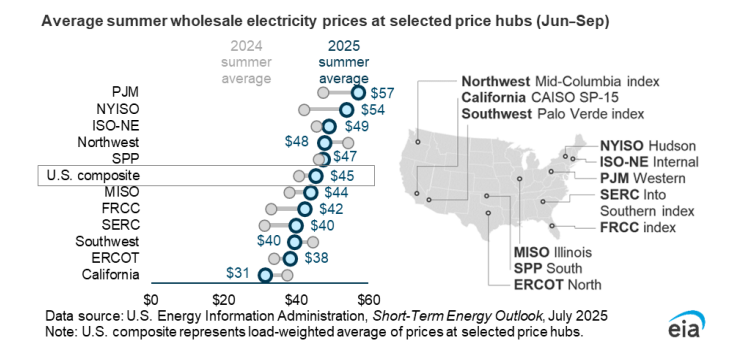

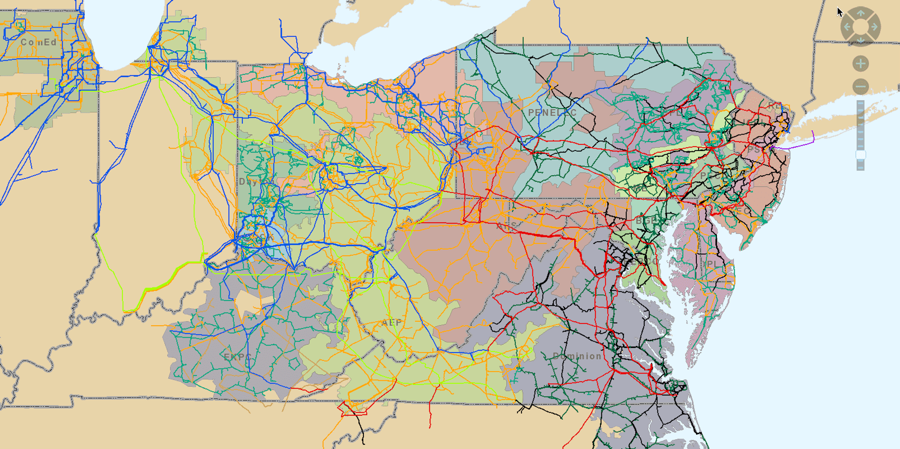

A new warning from the North American Electric Reliability Corporation (NERC) highlights a growing mismatch in PJM Interconnection, covering 65 million people across 13 states, as power demand surges faster than new supply can come online. Capacity prices for the 2025-26 cycle spiked 800% year-over-year, and that may just be the beginning.

Why It’s Happening

The driver? AI data centers, electrification mandates, and industrial reshoring. PJM expects peak load to rise from 152 GW to 184 GW by 2033, just as over 115 GW of fossil capacity retires. Meanwhile, siting and permitting bottlenecks are slowing the response.

This is no longer theoretical. Virginia, Maryland, and parts of Pennsylvania are already seeing constraints, with transmission congestion and limited spare capacity becoming real risks.

Infrastructure, not algorithms, is emerging as the limiting factor in AI scalability. What was once an energy supply issue is now shaping investment timelines, siting decisions, and competitive advantage.

What Investors Should Watch

- Capacity value is rising. PJM’s recent price spike reflects the market’s signal: new, reliable supply is urgently needed.

- Infrastructure optionality matters. Investors in data centers, logistics, and electrification-linked real estate need to stress test their grid access assumptions.

- Distributed solutions are gaining traction. Microgrids, storage, and demand side flexibility aren’t niche, they’re necessary.

States like West Virginia and Ohio are already rewriting permitting laws to prioritize projects that offer grid relief. This reshuffling of regulatory priorities creates new angles for smart capital.

Smartland Energy’s Perspective

Smartland Energy is actively tracking where digital demand is clashing with physical constraints and where investment can get ahead of it. We’re particularly focused on Appalachia and the Mid Atlantic, where grid headroom is limited, but land access and permitting pathways are opening up.

The bottom line: AI isn’t just straining the grid, it’s reshaping how and where energy gets built. Capacity is becoming a premium asset, and the investors best positioned for this new reality will be the ones who understand and plan for the hurdles.