As turbine backlogs stretch into the next decade, the grid, and the AI industry, are entering a new era of scarcity.

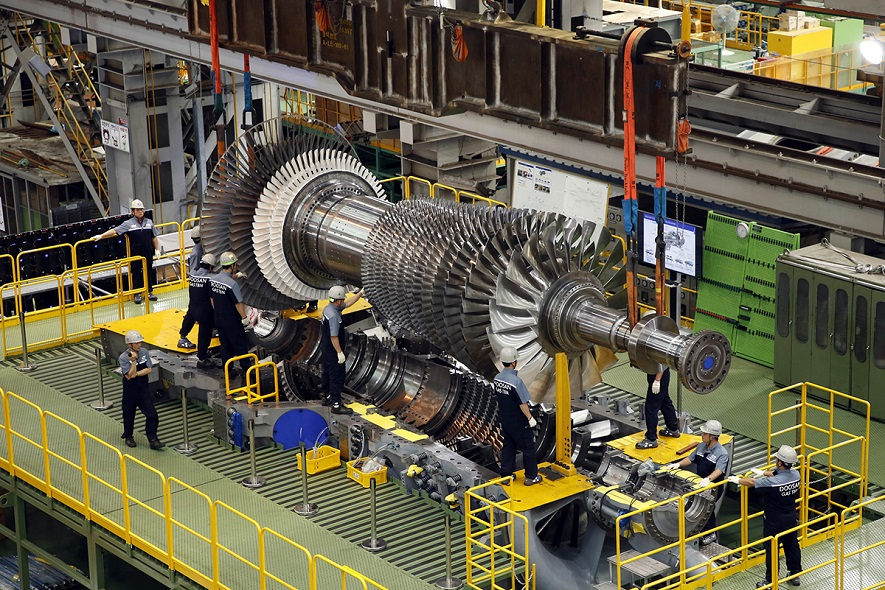

The Rocky Mountain Institute (RMI) recently flagged a critical inflection point in U.S. energy strategy: gas turbines, once a go to solution for peaker power and grid reliability, are now backordered well past 2028. With OEM order books full and spare parts thinning out, utilities can no longer assume they can “just add gas” to meet rising summer peaks or AI driven demand surges.

This bottleneck is a flashing red signal for the AI economy. Data center growth is accelerating, but the dependable power needed to scale that compute is no longer a given.

The Real Constraint on AI Isn’t Compute, It’s Capacity

For years, hyperscalers and infrastructure planners alike assumed that gas peakers would serve as a flexible backbone behind solar, wind, and intermittent renewables. That model just failed a real world stress test. Like GPUs, turbines are now in short supply, locked up by a few vendors with long lead times and complex IP. In both cases, physical constraints, not software, are setting the pace.

What Comes Next: Opportunity in the Crunch

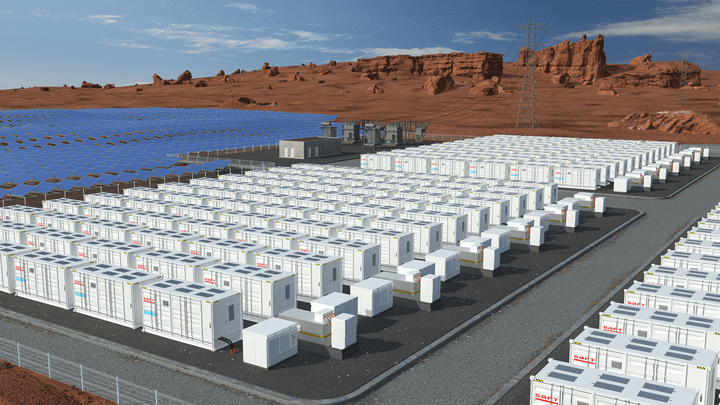

With new gas units delayed, RMI points to faster deploying solutions:

- Modular batteries

- Demand side flexibility

- Targeted efficiency

- Selective transmission upgrades

These solutions won’t just support the grid, they’ll define the economics of AI infrastructure for the next decade.

If you’re an energy aware investor, here’s the signal: the ability to hedge power costs, secure reliable load, and monetize flexibility isn’t a side concern, it’s now the moat.

Smartland Energy’s View

This turbine crunch makes one thing clear: AI infrastructure isn’t just software, it’s steel, substations, and sovereign megawatts. Smartland Energy continues to monitor where next-gen compute and resilient power converge, especially in grid challenged and high growth regions.

If you’re watching AI, you should be watching energy even closer.